How to Transfer money to Venmo

One of the best things about Venmo is that you never have to worry about adding money or if you’ll have enough as long as your Venmo account is linked to your bank account.

Even if your Venmo account has no money in it, you can still make a payment.

In the event that you enter a payment amount that is higher than what is available in your Venmo account, Venmo will automatically deduct the additional funds from the associated funding source. (That’s another story if you don’t have the money in your bank account.)

Only Venmo users with the Venmo Mastercard Debit Card have the choice to add money straight to their Venmo balance from a verified bank account (opens in a new tab).

Simply carry out the actions below.

Therefore, simply follow the instructions below if you have a Venmo Mastercard Debit Card and wish to add money to your Venmo balance:

How to add money to your Venmo account?

- Add a bank account Add a bank account to your Venmo profile and verify it if you haven’t already.

- Then select Manage Balance. Open the Venmo mobile app, select “Manage Balance” from the menu that appears at the top of the screen, and then press “Open.”

- Click “Add Money” and type the transfer amount. After entering the desired transfer amount, select “Done.”

- Select “Next” after verifying the bank account from which you want to send funds.

- After carefully reviewing the transfer details and anticipated arrival time, select “Add Money.”

Once you’ve done this, your transfer cannot be canceled.

How long does it take for money I add to arrive in my Venmo balance?

Standard Add Money transfers usually take 3-5 business days to reach your Venmo balance, and until they are finished, the funds from those transfers are not accessible.

There are a few crucial considerations regarding these transfers:

- The timing of your transfer can be impacted by several factors, such as weekends or holidays

- You may see a completed charge in your bank account while the transfer is processing and before those funds reach your Venmo account

- You can check the status of your transfer in the Venmo app in your personal transactions feed under the “Me” tab

Please get in touch with Venmo Support if the funds aren’t in your Venmo account after 5 business days.

Transfers are examined, which may cause delays, the freezing or removal of funds from your Venmo account, or both.

Review Transfers into and Out of Venmo Reviews for additional information.

Why can’t I see a money-adding option in my Venmo app?

Currently, the only users who can manually contribute money to their Venmo balance are those who have requested and received a Venmo Debit Card.

Find out more information about requesting a Venmo Debit Card.

Remember that you can pay people or companies on the app without adding funds to your Venmo balance.

Can I fund my Venmo account at a bank or retail location?

The Venmo app is currently the only place where you may add money to your Venmo account.

Right now, there isn’t a method to fund your Venmo account with actual cash.

Is there a way to deposit money into my Venmo account that is equivalent to “Instant Transfer”?

It’s possible for some Venmo Debit Card users to instantly add money to their Venmo balance.

By selecting “Manage Balance” at the top of your personal transactions stream, you can add money to your Venmo balance in the app (in the “Me” tab).

The money will be immediately added to your Venmo account if you select “Instant.”

Please be aware that the charge won’t appear on your bank statement for a few days (typically 3-5 business days).

Can I use a debit card to rapidly add money to my Venmo account?

Users of Venmo can only currently make this kind of transfer straight from a bank account.

Why aren’t the payments taken immediately from my bank?

When you need money in a hurry, like when you’re standing in line at the register and realize the money in your Venmo account won’t cover the purchase, we want to make sure you have the option to get money into your account straight away.

The way these transfers work is that the charge won’t appear right away on your bank statement.

That debit will typically take 3-5 business days to process.

Is it possible to revoke a transfer to my Venmo balance?

Once a transfer has been started to your Venmo balance, it cannot be stopped.

This kind of transfer cannot be cancelled by the Venmo Support staff.

Instead, you can transfer the money back to your bank once it has finished if you decide to change your mind after starting a transfer to your Venmo amount.

What if the payment to my Venmo balance is unsuccessful?

Several factors can cause transfers to fail. You will receive an email notification if the transfer to your Venmo balance is unsuccessful, and the money won’t be sent from your bank to your Venmo balance.

Are there any restrictions on the amount I can deposit into my Venmo balance?

The maximum amount that can be added to your Venmo balance each week is $1,500.00.

Following the moment of the transaction, a transaction counts toward your weekly rolling limit for exactly one week.

For instance, if you add money to your Venmo balance on a Monday at 11 AM, that transaction will stop counting against your limit at exactly 11:01 AM on the following Monday.

The Bancorp Bank, under license from Mastercard International Incorporated, issuing the Venmo Mastercard Debit Card.

The Bancorp Bank; FDIC member Anywhere in the United States that accepts Mastercard, you can use the Venmo Debit Card.

The circular design is a trademark of Mastercard International Incorporated, and Mastercard is a registered trademark.

how long does it take for Venmo to go through?

According to the statement on the Venmo site, it takes about 1-3 business days for the money to arrive in the receiver’s account

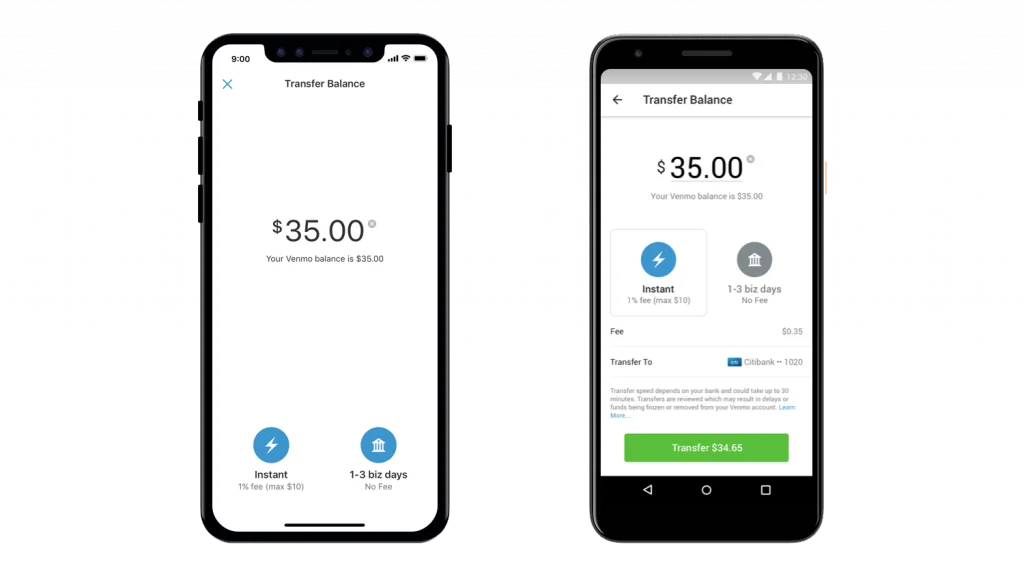

Money Transfer to Your Bank Account

The maximum amount of money you can transfer to your bank account each week while your identification is still being verified is $999.99. (depending on security checks at Venmo).

By establishing your identification, you can increase this restriction (see instructions below).

- When you do, you can send your bank up to $19,999.99 per week.

- The maximum sum that can be deposited into your bank account at once is $5000.

- Transfers may be rejected for reasons outside of the cap.

- You can only send money instantly if it costs $0.26 or more.

- Our regular bank transfer option is available to use if you need to transfer less than $0.25.

Limits on rolling When a bank transfer is made at 11 a.m. on a Monday, it stops counting against your limit at 11:01 a.m. the following Monday.

You can use the service to transfer funds to other Venmo users for nearly any purpose, such as covering your portion of the brunch tab or hiring a babysitter. By installing the Venmo app on their smartphone or creating an account on the Venmo website, anyone over 18 with a bank account, debit card, or credit card can open a Venmo account.

There are no costs associated with opening a Venmo account, either. It has been mentioned that a straightforward Venmo transaction from a user’s bank account, debit card, or Venmo cash balance is free. Venmo assesses a 3% fee to the sender if a credit card is used for payment.

If you enjoyed this article please share this article, it will go a long way for us. Also, subscribe to our newsletter, follow us on Facebook, Twitter, Pinterest, Google News, and Instagram for more

“Please leave your comments. Let’s us know what you think, this helps us improve our next article”

Source: fifty7tech.com