why is Venmo declining my payment?

Peer-to-peer payment apps that can be downloaded to cell phones are the hottest new thing.

Venmo appears to be the app of choice among pals who go cashless but still need a straightforward way to share a dinner tab.

Other options include Apple Pay and Zelle.

A quick Google search for Venmo statistics reveals that the app has been used millions of times to move hundreds of millions of dollars, frequently between friends and relatives.

How Venmo Works

If you’ve never used Venmo, here are the basics:

- Download the app for free

- Enter your bank account or credit card number

- Sync the app to your phone and Facebook contacts

- Select a contact you want to pay

- Enter the amount you want to send and what the money is for

- Tap the pay button

It’s a quick and easy way to pay for dinner together, give a pal gas money, or divide the cost of mom’s flowers.

Why is Venmo declining my payment?

Is a glitch preventing your Venmo payment? Find out why you could be experiencing this problem by reading on.

Zintego Photography Invoice TemplateZintego Photography Invoice Template is all about capturing the perfect moment.

A few common reasons for payment failing on Venmo are:

- Your bank or card issuer is declining the transaction (outside of Venmo)

- The payment has triggered one of Venmo’s automated security flags

Contact your bank or card issuer directly if you’re making a payment using a credit card, debit card, or bank account (the fastest way to reach them is by calling the number on the back of your card).

Venmo is unable to override or see the circumstances of a decline made by your bank or credit card company if the transaction is being declined.

You could also try paying with a different card or a different payment method.

We advise trying the payment later if you’ve checked with your bank or card issuer.

Try using a different payment processor, such as PayPal, our parent company, if it’s urgent.

Error Messages

Try these troubleshooting steps sequentially if you’re receiving an error message from the program that doesn’t contain any clear guidance.

They frequently find solutions to the majority of problems:

- Make sure you’re connected to the internet (Wi-Fi or data) and have enough storage/memory available on your device. If you are using a VPN, try turning it off to see if it resolves the issue.

- Log out of your Venmo account and back in.

- Delete the Venmo app and reinstall. (This does not affect your Venmo account. It also ensures you’re using the newest version of the app.)

- Make sure your device OS is up to date.

Please get in touch with the Venmo Support staff via their official website if you’ve tried the aforementioned troubleshooting steps but the problems still exist.

400 / 403 errors

These error warnings typically mean that you are attempting to use the Venmo app in a way that is either impossible or prohibited.

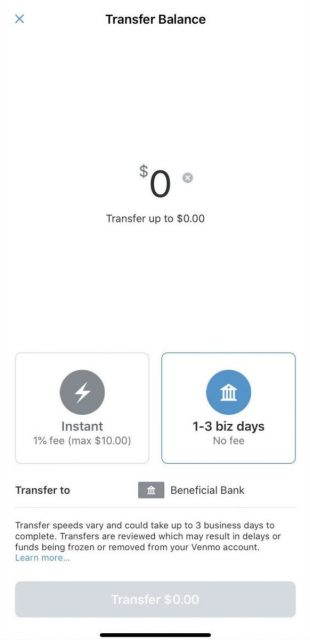

- If you’re trying to send a payment or bank transfer, make sure you haven’t reached your limits by visiting our articles on payment limits and bank transfer limits.

- If you’re trying to log into your Venmo account, make sure you’re choosing “Sign In” instead of “Sign Up.” Remember that you can only log into Venmo from the U.S.

“Bad state” errors

This error message indicates that there are or were technical problems with Venmo.

Check your transaction history in the app to see whether you attempted to make a payment or bank transfer to see if it was successful.

Please attempt it again later if it fails.

How to Avoid Being Burned When Using Venmo

If you’ve already been to Venmo’s official website, you know that there are just two specific reasons why a payment on this platform will be denied.

- A linked bank account or a debit card is causing an issue.

- There is an automated security flag that the authorities have to check before allowing the payment transfer.

Having said that, there may be a variety of unrelated causes that lead to a failed Venmo transaction.

Discovering the cause of your failed Venmo payment is possible, and fortunately, the majority of these issues are simple to resolve. Here are a few of them for you to think about.

- Network issues could be causing a problem.

- Transaction load is another reason why Venmo may decline your payments.

- A blocked bank account or debit card also does not let the payment be processed.

- If the app is unresponsive, the payment will not be processed.

- Online transfers will also be hampered by maintenance on the bank’s or the apps’ end.

Also, keep in mind that Venmo does not accept payments from other countries. As a result, if you attempt to make one, it will be rejected.

The best way to get a refund if a Venmo payment failed.

It is unlikely that any money would be taken from the balance if the payment from your Venmo app fails. As a result, you won’t need a refund.

- However, there are instances where the money is taken out even though the recipient hasn’t yet been charged.

The best course of action if you have encountered this is to contact Venmo customer service.

Depending on how comfortable you are, you can either phone the authorities personally or through their toll-free number.

When they send money to the incorrect account and the payment has already been made, some customers think about getting a refund.

Where a pending transaction can be canceled, Venmo won’t reimburse you if you make a mistaken payment.

Again, you might get better advice in this area from the official support staff.

How To Fix Venmo Payment Issue – Step By Step Guide

The issue of a Venmo payment being refused often results from problems with the bank, the card, or if an automated security warning is raised.

Despite the fact that it may seem like there is little you can do in either situation, experts have advised certain troubleshooting procedures that could be helpful.

Verify that your Venmo account is current, that you have adequate money, and that your account has not been put on hold as a result of any problems before attempting any of these hacks.

All right? Here is what you need to do right away.

- Improve your internet connection to ensure that there are no network problems throughout the transaction.

- Wait until you can do the transfer using your own device rather than using a public computer. You may then be certain that the internet is not the cause of this.

- Run an antivirus scanning program on your device.

- Turn off VPN services since they may impede money transfers. Any location services that you may have enabled are subject to the same rules.

- Check the date and time on your phone as well as the information you are providing for the receiver once more.

- To ensure that no app maintenance is taking place, speak with the bank.

- Wait for the network problems to get fixed on their own.

- If the issue persists, you can also replace your debit card or bank account.

- Additionally, make sure your account has enough money.

venmo’s automated security flags

Venmo uses automated security flags to identify potentially fraudulent or suspicious activity on its platform. These flags can be triggered by a variety of factors, such as:

- Large or unusual transactions: Venmo may flag transactions that are large or unusual for your account.

- Payments to new contacts: Venmo may flag payments to new contacts. This is because scammers often create new accounts and try to send payments to unsuspecting users.

- Payments from different locations: Venmo may flag payments that are made from different locations.

- Payments with unusual payment descriptions: Venmo may flag payments with unusual payment descriptions. For example, if you send a payment with a payment description that includes keywords like “refund,” “chargeback,” or “dispute,” Venmo may flag the transaction.

Go into the settings and select ‘Apps’. Look for the Venmo app, tap it, select ‘Storage,’ and then hit the ‘Clear cache’ button at the bottom. The data on your phone should be cleaned out.

The following are a few frequent causes of Venmo payment failures: The transaction is being declined by your bank or card company (outside of Venmo) One of Venmo’s automatic security flags has been raised due to the transaction.

Automatic Flags: Before completing a transaction, Venmo will flag a user if we suspect they are sending money to the incorrect recipient. We consider details like if they are sending money to someone they have never paid before and whether they have any Venmo buddies in common.

If you enjoyed this article please share this article, it will go a long way for us. Also, subscribe to our newsletter, follow us on Facebook, Twitter, Pinterest, Google News, and Instagram for more

“Please leave your comments. Let’s us know what you think, this helps us improve our next article”

Source: fifty7tech.com